The Pandemic Effect: Can Bangladesh Overcome Covid-19 Impact on its External Sector?

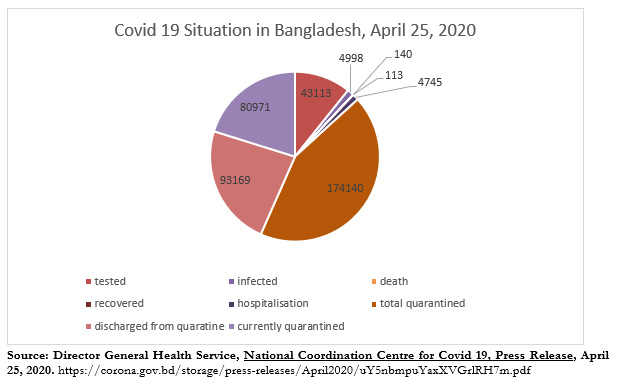

Out of the 210 countries that are affected by Coronavirus (Covid-19) which has resulted in 1,96,000 deaths worldwide, Bangladesh up till now have witnessed only 140 deaths. However, there has been a dramatic spike in the number of people who have tested positive for Covid-19. The figure for those affected by Covid-19 as it stands on April 25 is 4998 compared to 56 infections as reported on April 01. 4745 infected are under hospitalisation and since the outbreak it has quarantined 1,74,140 and have isolated 33,13,310 people.[1] Bangladesh has now established 17 testing facilities to increase the capacity to test which is still inadequate for a country that has more than 160 million population – the most densely populated country of the world.

The government has asked the army for help and the armed force is helping in enforcing social distancing, ferrying medical aid and help to ensure quarantine of those who returned from abroad. Meanwhile, India has supplied masks and other items worth $1 million to several countries of the region including Bangladesh from its contribution of US $10 million to the SAARC Covid-19 fund. The US and the UK have extended financial aid and government has further requested China to help with supply of additional masks. The Asian Development Bank has pledged $602.39 million for immediate use to tackle the Covid-19 crisis. The government is facing severe shortage of ventilators and has only 1,267 ventilators – 520 in the government hospitals and 737 in the private hospitals. The ventilators are lopsidedly distributed – 926 in Dhaka and 341 in other districts of Bangladesh[2] as health care remains the privilege of few elites. It is true that many of the Western advance countries which are sparsely populated are facing serious crisis to contain the spread of the disease. Compared to them, the country is densely populated and containing the spread would become a major challenge. Bangladesh, however, is facing challenges at several fronts. Not only the country has dilapidated health care system and inadequate testing facilities but the immediate crisis that confronts the country is the possibility of many people working in private sectors losing their jobs. The impact of Covid-19 on the Ready Made Garment (RMG) Industry that employs large number of workers, especially the females, is going to be huge. The unemployment would severely affect their families and several others who are dependent on their meagre income and this may create social unrest. Mostly in the urban areas, 13.5 per cent of the households are headed by the females.[3] In addition, the news of closure of factories in several Middle Eastern countries especially the Gulf would not only affect the flow of remittances but would add to unemployment situation.

Covid-19 and Economic Down Turn

For past one decade, Bangladesh has witnessed impressive economic growth. The country has been growing between 6-8 per cent. It has performed impressively on Sustainable Development Goals (SDG) and is much ahead of all the South Asian countries in establishing gender parity. The Ready-made Garment (RMG) industry is the largest employer of women labour force and this sector is currently under stress due to Covid-19. According to Labour Force Survey 2017-18, those who train to work in the RMG sector is dominated by females and the ratio which interestingly is 3.5 per cent males to 10.2 per cent females.[4] Though, this ratio has reduced if one compares the Quarterly Labour Force Survey of 2017-18 to the data of 2015-16, which puts the ratio at 8.6 per cent of males to 20.6 per cent females who participate in the training programme that open up the opportunity to be employed in the RMG sector.[5] There are 1.7 million males and 1.5 million females who are working in RMG sector[6]. Compared to other professions, women employment is the highest in garment sector. This article discusses the impact on Bangladesh’s two important external sectors on its economy: Readymade garment industries that generate more than 80 per cent revenue and remittances of Bangladeshi workers working mainly in Gulf countries and who contribute to the foreign exchange reserve and in 2018-19 Financial year, remittances covered nearly 75 per cent of the fiscal deficits.[7]

Covid-19 Impact on Ready Made Garment Sector

Both export earnings from garment sector and remittances are two main sources of contribution to foreign exchange revenue of Bangladesh; even though the garment sector[8] has seen a decline in export. These two sectors are going to be seriously affected. Already in the garment sectors, many factories are closed due to the lockdown rendering many people jobless. The situation of employment is extremely bad. This can be gauged from the fact when there was rumour that factories are reopening, most of the workers who had left for home when government announced lockdown, rushed back – some walking and some by bribing the driver of whatever vehicle they could get to travel to their work place to collect their salaries for March and to join fearing loss of job if they do not join work.[9] Unfortunately, they found the factories still under lockdown and many of them are yet to receive their salaries.[10] The Bangladesh Garment Manufacturer and Exporter Association (BGMEA) issued a directive to factory owners to pay wages.[11]

The garment owners are equally facing financial trouble as orders are getting cancelled and rescheduled due to Covid-19. Therefore, for the owners to pay the workers is also becoming difficult. In a joint statement of STAR Sustainable Textile of the Asian Region of which the BGMEA is a part, made a request to the global brands to “take delivery or shipment, and proceed with the payment as agreed upon for goods already produced and currently in production with materials ready, and not cancel orders which are already in production; offer fair compensation to suppliers (100% FOB) if production or delivery has to be suspended or stopped, or offer salaries directly to workers of suppliers” among several other demands.[12] According to BGMEA, out of 4,200 factories, 1,143 factories have reported a loss of US $3.17 billion affecting 2.27 million workers due to cancellation of orders to the tune of 980 million pieces.[13]

According to a report, Bangladesh imported textile fibre and articles worth US $5.02 billion, out of its total $13.63 billion import, from China in fiscal year 2018-19.[14] In February itself, the BGMEA wrote a letter to the Prime Minister highlighting how due to Covid-19 in China, import of raw material that largely feed the garment industry is getting affected. According to another report, “the import from China was 41 per cent of the total import of cotton, cotton yarn/thread and cotton fabrics valued at $7 billion in the last fiscal year”.[15] According to Bangladesh Bank, in 2018-19, cotton, manmade fibre, knitted fabric, etc. constituted 41.3 per cent of total import from China.[16]

In Bangladesh, after the woven garments, the knitwear sector is the second largest contributor to revenue and together with the readymade garment industry; in the last financial year, they contributed 84.2 per cent of total export earnings.[17] Currently, the industry employs about 4.2 million workers, of whom 90 per cent are women, mostly from the rural areas.[18] It is interesting to note that garment sector is registering loss of revenue since last year. Export earning reduced by 7.74 per cent between July to November 2019. While 61 factories have been closed leading to 31,600 workers losing jobs. However, new opportunities were also created with the establishment of 58 new garment factories which employs almost 60,000 workers.[19] In spite of the opening of new factories, there is a downward trend in export for various reasons even though there is a forecast that the US-China Trade War would benefit Bangladesh garment industry,[20] the result is mixed given the globalisation.[21] The data of Bangladesh Bank showed that in manufacturing sector, the following sectors registered downward growth: Knitwear (-$5.13 million), Woven garment (-$6.29 million), Home textile (-$9.70 million), Special textile (-$9.97 million); all registered negative growth from July to January (FY 2019-20), when compared to the same period (FY 2018-19).[22] Bangladesh’s import of yarn is also reduced by 22.44 per cent in the same financial year. Import of raw cotton, textile articles and staple fibres from various countries showed a reduction.[23] This reduction in imports reflects that the RMG sector is facing challenge; because there is no evidence of import substitution of these items. There has been a discussion for some time in Bangladesh at the need to diversify its RMG export and move away from producing low end products like T-shirts, shorts, trousers, etc. to high end garment production sector. Diversifying export basket has remained a major challenge for Bangladesh.

The other factor that is going to be a challenge for the RMG and Knitwear sector is Bangladesh’s graduation from LDC to Middle Income country in 2021,[24] therefore duty free - quota free access which has helped Bangladesh’s RMG sector to grow to become second largest exporter, would no longer be available. It would now be subjected to Generalised System of Preferences (GSP) rule of the European Union, which is a major destination of Bangladesh RMG. According to a study by ECOSOC, Bangladesh “would face tariffs of 9.6 per cent in the EU under the GSP”.[25] It has to undergo stringent rule of origin and lose concession it is getting as LDC and this will affect woven garment sector the most.[26] Bangladesh, however, can apply for GSP+. While these are the challenges that need to be taken into account, the Covid-19 outbreak has further added to its woes. The closure of the factories for a month would impact both the industries as well as the workers. The stimulus package of US $590 million announced by Prime Minister Hasina specifically for garment industries to overcome short term crisis of paying wage and the offer of US $3.5 billion capital loan with lower interest is unlikely to help the industry much which employs largest number of workers.[27] Moreover, both United States and Europe are witnessing highest number of people with infections as well as death from Covid-19, generating a health crisis there. Bangladesh's RMG export to USA has increased by 4.5 per cent in 2018.[28] The US remains single largest market for Bangladesh’s garment industry. Its export to the EU constitutes 56.4 per cent of its total export. The lockdown in these countries would have severe repercussion not just on their economy and would impinge on Bangladesh’s economy as export to these countries may witness a decline. Already the signs are there where orders are being cancelled.

Many of the garment factory owners are also Members of Parliament. According to Shushasoner Jonno Nagorik (Shujan), 182 businessmen have been elected as lawmakers in 11th General Election. This amounts to almost 61.07 per cent of the total members of the parliament.[29] The businessmen-politician nexus has not helped much needed reform in the garment industries in Bangladesh. There are other problems like frequent strikes called by garment workers due to poor wage and safety of work place. These factors, however, are constant. Post-Covid-19, there is a possibility of garment workers demanding high pay as the inflation rises. Some of the garment factories are schedule to open from 28th of April and the workers staying near to the factory would join work.[30] It is equally true that many garment workers staying in other areas would attempt to join due to the fear of losing jobs and new jobs would be difficult to find.

Workers’ Remittances from Covid-19 affected countries

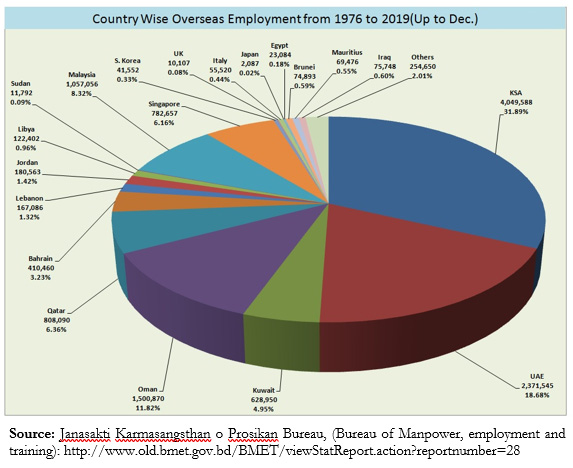

Many of the Bangladesh workers work in the Middle Eastern countries. This is revealed in the fact that Bangladesh receives largest remittance from Saudi Arabia (21 per cent) followed by the UAE (14 per cent), the US (12per cent), Kuwait and the UK (7 per cent), and Malaysia (7 per cent).[31] Most of these countries, especially the US and the UK are witnessing serious problems of Covid-19 with several thousand deaths. The Middle East is facing the spread of Covid-19. Some of the Bangladeshi workers have lost their jobs due to the lockdown and some are in the process of losing jobs.[32] Many of them live in cramped accommodation to save money. Fearing the spread of Covid-19, the UAE has asked the foreign workers to leave and has asked the host countries to arrange for their return. The UAE has announced ‘early leave’ for foreign undocumented workers, mostly working in private sector stranded in that country amidst lockdown and those who want to leave for their native countries.[33] It is considering several steps to pressurise foreign countries to take back their citizens who want to leave and have said that it would activate ‘quota system’ in recruitment and revoke Memoranda of Understanding (MoU) signed between the ministry and concerned authorities in these countries”.[34] Similarly, Saudi Arabia, Kuwait, Qatar, and Bahrain and also the Maldives have informed the Bangladesh government to take back undocumented workers working in these countries.[35] Around 1.5 lakh workers are waiting to leave Bangladesh for their employment destination mostly in the Middle East. Many of them generally borrow money to middle-men and recruiting agents to arrange for their visa, employment and logistics to reach their destination.[36] They stare at a bleak future. It needs to be noted, compared to the financial year[37] 2018-2019; there has been steady growth in the remittances in the 2019-2020 financial year as per data available with the Bangladesh Bank. For example, remittance figure for this financial year (July 2019 to February 2020) stood at US $12.49 billion compared to US $9.09 billion for the same period in the last financial year. The following graph shows country-wise recruitment and Saudi Arabia and the UAE dominate as destination of Bangladeshi workers.

The government has already announced 450 crore rehabilitation package announced by Overseas Workers Welfare Fund (প্রবাসী কল্যাণ তহবিল). Given the magnitude and uncertainty surrounding the treatment of Covid-19 pandemics, this amount would not suffice. Question here is, when would the factories and construction sectors where most of the foreign workers are employed is going to re-open in the Middle East? How would the government deal with the return of these expatriate workers to Bangladesh where no such employment opportunity to accommodate a few million overseas workers exists? The Finance Minister of Bangladesh, AHM Mustafa Kamal, has requested ADB to help the country to rehabilitate those who have lost their jobs. The finance minister has also sought $1.0 billion budget support in the next fiscal year (2020-21) in addition to $500 million budget support in current fiscal to overcome the shock of novel Coronavirus.[38]

Over the years, remittances has also helped households to improve the standard of living, enabled them to spend more on education and food, and repay loans, etc. Not just remittance would have impact on economy, but according to a study on the pattern of expenditure of the workers shows that the expatriate workers spend 29.8 per cent of their income on personal consumption abroad; they send 44.9 per cent of their income back home and save 22.8 per cent.[39] This beneficial impact of remittances is going to be seriously affected and would affect life-style of individual. According to Annual Labour Survey, 88.0 per cent of the employed are in informal sector employment, whereas it was 77.3 per cent in urban areas. In rural areas, 93.3 per cent of the females are in informal sector employment, whereas it was 87.4 per cent in urban areas.[40] The BGMEA has announced that the factory should close under Sections 12, 13 and 16 of Chapter 2 which pertains to conditions of employment and service under the Bangladesh Labour Law.[41] The application of this section means the workers would be considered as laid off and would be denied wage. However, garment workers working in factories in Export Processing Zone are under a separate labour law. Bangladesh Export Processing Zone (EPZ) Labour Bill 2019 which would mean the workers who have worked for a year will get nominal pay during the lockdown period. The Bangladesh Bank has notified that those garment industries which would lay off their workers would not receive any incentive that has been announced by the government.[42] This has happened after many garment workers complained of not receiving any salary especially workers in Gazipur, Narayanganj, Chittagong, etc.[43]

The informal sector is likely to get affected the most; as the prices of essential commodity has seen an increase. Except for farm, other small enterprises have been shut down. The economic impact of Covid-19 would be felt across the various sectors of the economy. Revenue loss from export may impact on social sector spending. Loss of remittances would have its impact. Bangladesh has to prepare for a long haul and need to give a rethink to the structure of its external sector.

[1] Government of Bangladesh, Director General Health Service, Press Release, April 25, 2020, https://corona.gov.bd/storage/press-releases/April2020/uY5nbmpuYaxXVGrl…

[2] Syed Saimul Basher Anik, “Coronavirus: Bangladesh facing severe ventilator shortage”, Dhaka Tribune, April 14, 2020, https://www.dhakatribune.com/bangladesh/2020/04/14/coronavirus-banglade…

[3] Ministry of Planning, Quarterly Labour Force Survey, Bangladesh, 2015-16, Bangladesh Bureau of Statistics, March 2017, p.27

[4] Ministry of Planning, Labour Force Survey, 2016-2017, January 2018, p.36, http://203.112.218.65:8008/WebTestApplication/userfiles/Image/LatestRep…

[5] Ministry of Planning, Quarterly Labour Force Survey, Bangladesh, 2015-16, Bangladesh Bureau of Statistics, March 2017, p.36. http://bbs.portal.gov.bd/sites/default/files/files/bbs.portal.gov.bd/pa…

[6]Labour Force Survey, 2016-2017, published in January 2018, p.250

[7] Zahid Hussain, “What is riding on remittance?”, The Daily Star, January 29, 2020, https://www.thedailystar.net/business/gdp-growth-rate-in-bangladesh-wha…

[8] It includes readymade garments, knitwear sectors mainly

[9] Waves of RMG workers return to Dhaka from Mymensingh, Dhaka Tribune, April 03, 2020, https://www.dhakatribune.com/bangladesh/nation/2020/04/03/waves-of-rmg-…

[10] Editorial, পোশাকশ্রমিকদের মজুরি (The wage of Garment workers), Prothom Alo, April 18, 2020, https://www.prothomalo.com/opinion/article/1651540/পোশাকশ্রমিকদের-মজুরি

[11] https://www.bgmea.com.bd/home/activity/Disburse_wages_ensuring_workers_…

[12] Joint Statement on Responsible Purchasing Practices amid the COVID-19 Crisis, https://www.bgmea.com.bd/home/activity/Joint_Statement_on_Responsible_P…

[14] Monira Munni, “Coronavirus: BGMEA seeks policy steps to face challenges”, Financial Express, February 20, 2020, https://thefinancialexpress.com.bd/trade/coronavirus-bgmea-seeks-policy…

[15] Sohel Parvez, “Imports from China tumble 21pc for coronavirus, Daily Star, February 25, 2020, https://www.thedailystar.net/business/news/imports-china-tumble-21pc-co…

[16] Bangladesh Bank, “Country/Commodity wise Import Payments under (Cash+Buyer's Credit+ IDB/ITFC Loan+ Loans & Grants)”, :https://www.bb.org.bd/openpdf.php

[17] Bangladesh Bank, Annual Report, Chapter 11, External Sector, p.121, https://www.bb.org.bd/openpdf.php

[18] https://bkmea.com/about-us/bangladesh-knitwear-industry/

[19] Textile Today, 2019 in Review: Bangladesh textile and apparel industry, January 05, 2020, https://www.textiletoday.com.bd/2019-garment-sector-experiences-peacefu…

[20] Jon Emont, “Trade War Pushes Garment Companies Back to Bangladesh”, September 06, 2019, Wall Street Journal, https://www.wsj.com/articles/trade-war-pushes-garment-companies-back-to…

[21] Bangladesh Bank, Annual Report, Chapter 11, External Sector, See Box 11.1 Impact of USA-China Trade War on Bangladesh Economy, pp. 119-120, https://www.bb.org.bd/openpdf.php

[22] Bangladesh Bank, “Commodity wise export shipments (Monthly Data)”, https://www.bb.org.bd/econdata/bop/exp_rcpt_merchandise.php

[23] Commodity-wise import statistics recorded by customs[Monthly] https://www.bb.org.bd/econdata/bop/imp_pay_marchandise.php

[24] The actual graduation will happen in 2020 after Bangladesh meets several criteria.

[25] Secretariat of the Committee for Development Policy, United Nations Department for Economic and Social Affairs, “Ex ante assessment of the possible impacts of the graduation of Bangladesh from the category of Least Developed Countries (LDCs”, April 01, 2019, https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/IA…

[26] Bangladesh´s exports would also have to comply with more stringent rules of origin to benefit from the GSP than it is required to, as an LDC, to benefit from EU’s ‘Everything But Arms’ duty free trade concessions. Bangladeshi garments currently benefit from the single transformation rule for LDCs, whereby products qualify for preferential treatment if only one form of product alteration is undertaken in the country as opposed to the double transformation rule for non-LDCs, whereby two stages of conversion are required. “Ex ante assessment of the possible impacts of the graduation of Bangladesh from the category of Least Developed Countries (LDCs)”, Ibid.

[27] Ahammad Foyez, “Bangladesh PM unveils Tk 72,750cr stimulus packages”, New Age, April 05, 2020, https://www.newagebd.net/article/103845/bangladesh-pm-announces-tk-7275…

[28] Bangladesh Bank, Annual Report, p.119, https://www.bb.org.bd/openpdf.php

[29] “182 businessmen elected to Parliament”, Prothom Alo (English), January 07, 2019, https://en.prothomalo.com/bangladesh/182-businessmen-elected-to-parliam…

[30] Government formed a task force headed by Shafiul Islam Mohiuddin, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) to set dates for reopening of the apparel industry. apparel factories located in the region covering Ashulia to Manikganj will reopen on April 28 and 29, while factories in Gazipur, Narsingdi and Kanchpur will run from April 30. See Ibrahim Hossai Ovi, “Covid-19: Apparel factories to reopen in phases, zone-wise on Sunday”, Dhaka Tribune, April 25, 2020, https://www.dhakatribune.com/business/2020/04/25/covid-19-apparel-facto…

[31] Bangladesh Bank, “Wage Earner’s Remittance Inflows: Selected Country Wise (Monthly)”, July 2019-February 2020.

[32] Soharab Hossain,

বড় কষ্টে আছেন প্রবাসী শ্রমিকেরা, সহায়তা জরুরি (Workers are in Difficulties, They need Help), Prothom Alo, April 18, 2020, https://www.prothomalo.com/opinion/article/1650841/বড়-কষ্টে-আছেন-প্রবাস…

[33] “Covid-19 in UAE: Company to book ticket for expat worker taking 'early leave', Khaleej Times, April 05, 2020, https://www.khaleejtimes.com/coronavirus-pandemic/combating-covid-19-ua…

[34] Tawfiq Nasrallah, “COVID-19: UAE considers imposing restrictions on these countries”, Gulf News, April 12, 2020, https://gulfnews.com/uae/government/covid-19-uae-considers-imposing-res…

[35] Porimal Palma and Jamil Mahmud, “Countries dealing with Covid-19 ask Bangladesh to take back its undocumented workers”, The Daily Star, April 09, 2020, https://www.thedailystar.net/backpage/news/another-worry-bangladesh-189…

[36] Mohammad Owasim Uddin Bhuyan, “Thousands of Bangladeshi migrants jobless”, New Age, March 19, 2020, https://www.newagebd.net/article/102618/thousands-of-bangladeshi-migran…

[37] Bangladesh’s Financial Year starts from July and ends in June.

[38] Kamal seeks $1.0b budget support from ADB in FY21”, Financial Express, April 20, 2020. https://thefinancialexpress.com.bd/economy/kamal-seeks-10b-budget-suppo…

[39] BMET, Dr. Md. Nurul Islam, “Migration from Bangladesh and Overseas Employment Policy”, p.8, https://bmet.portal.gov.bd/sites/default/files/files/bmet.portal.gov.bd…

[40] Bangladesh Bureau of Statistics Report on Labour Force Survey (LFS) 2016-17, January 2018, p.16, http://203.112.218.65:8008/WebTestApplication/userfiles/Image/LatestRep…

[41] Bangladesh Gazette, Bangladesh Labour Act, 2006, October 11, 2006,

ACT NO. XLII OF 2006 http://www.dpp.gov.bd/upload_file/gazettes/14212_75510.pdf, pp.7904-7906.

[42] লে-অফ করা কারখানা ৫ হাজার কোটি টাকার তহবিলের অর্থ পাবে না (Industries that laid off workers would not be eligible for Tk 5000 crore incentive”, Prothom Alo, April 20, 2020, https://www.prothomalo.com/economy/article/1652035/লে-অফ-করা-কারখানা-৫-…

[43] Many Bangladesh factories renege on promise to pay by April 16”, New Age, April 16, 2020”, https://www.newagebd.net/article/104528/many-factories-renege-on-promis…